pa unemployment income tax refund

Ad File your unemployment tax return free. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Premium federal filing is 100 free with no upgrades for premium taxes.

. Record your taxable income from Line 9 of your PA-40 Personal Income Tax return. Check The Refund Status Through Your Online Tax Account. Ad Learn How Long It Could Take Your 2021 Tax Refund.

NEXSTAR The IRS announced Thursday that it will be recalculating the taxes Americans paid on unemployment benefits to make sure. Register to Do Business in PA. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in.

This is the fourth round of refunds related to the unemployment compensation. Report the Acquisition of a Business. If filing as married or unmarried use the column to the left to report income amounts.

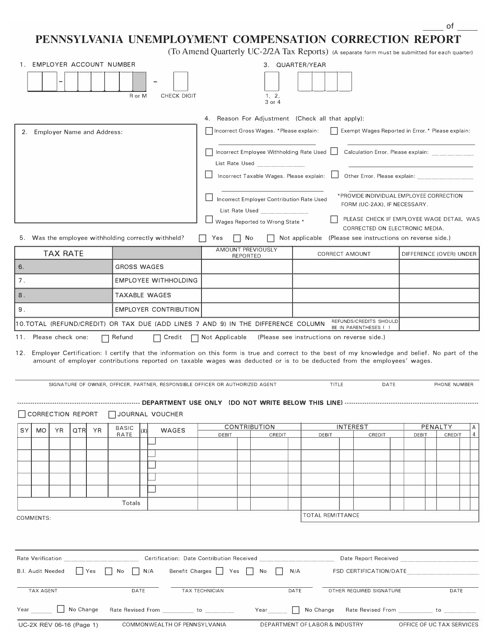

MyPATH functionality will include services. Make an Online Payment. The surcharge adjustment is computed by multiplying your basic rate by the 54 percent surcharge.

- Personal Income Tax e-Services Center. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can. The first refunds are expected to be issued in May and will continue into the summer.

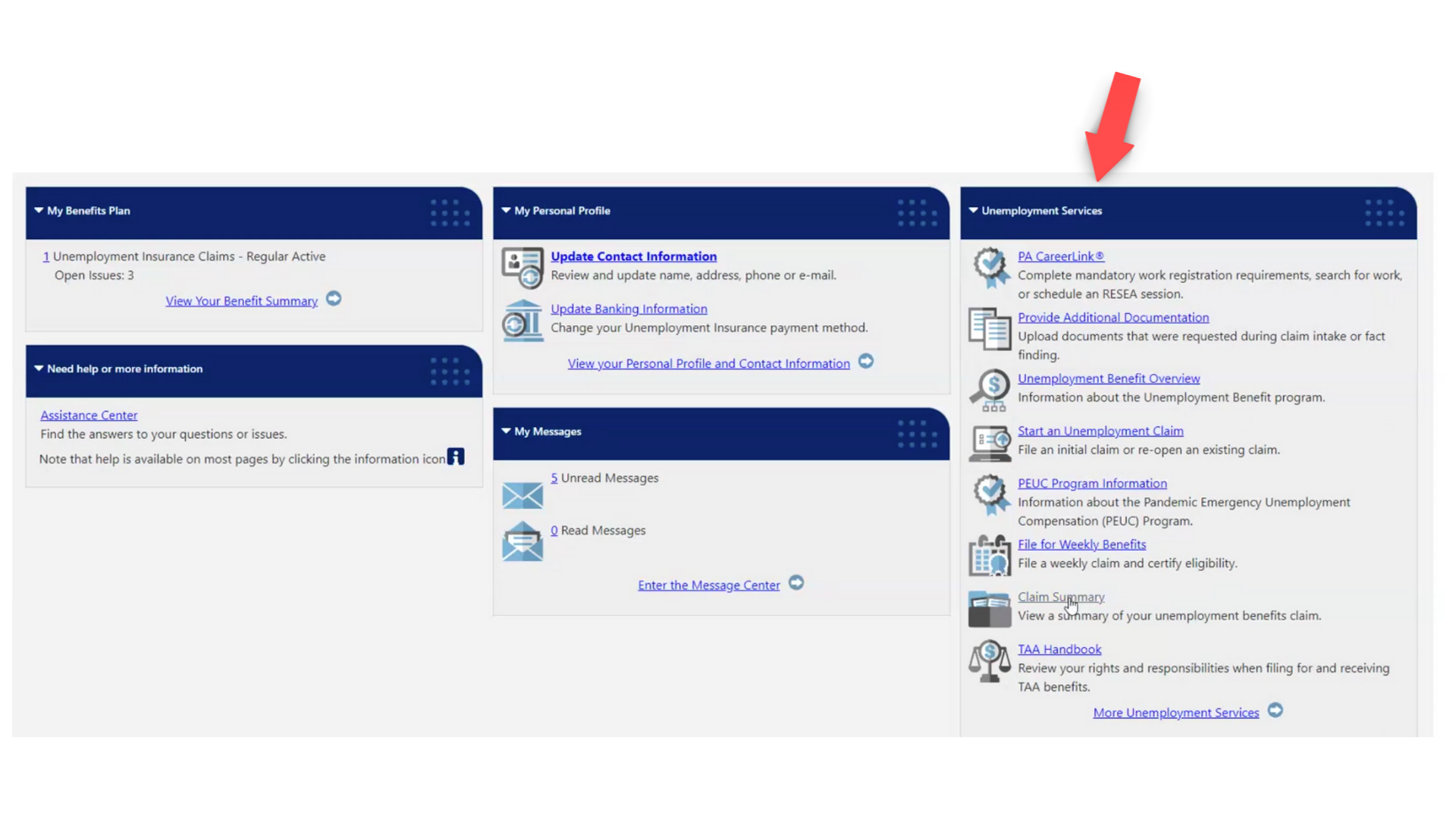

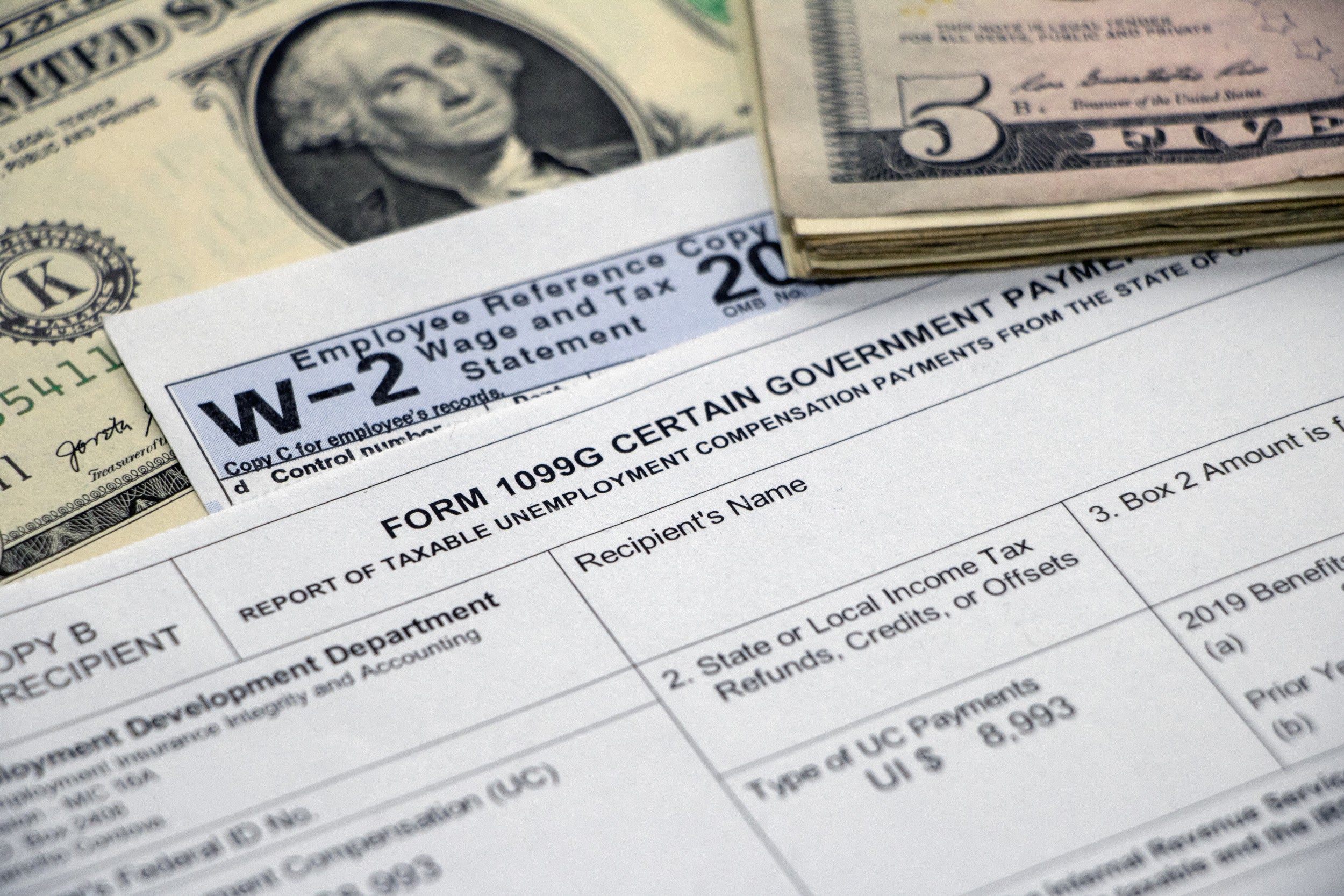

Register for a UC Tax Account Number. See How Long It Could Take Your 2021 Tax Refund. 1099-G Tax Form Information you need for income tax filing T he Statement for Recipients of Certain Government Payments 1099-G tax forms are mailed by January 31 st of each year for.

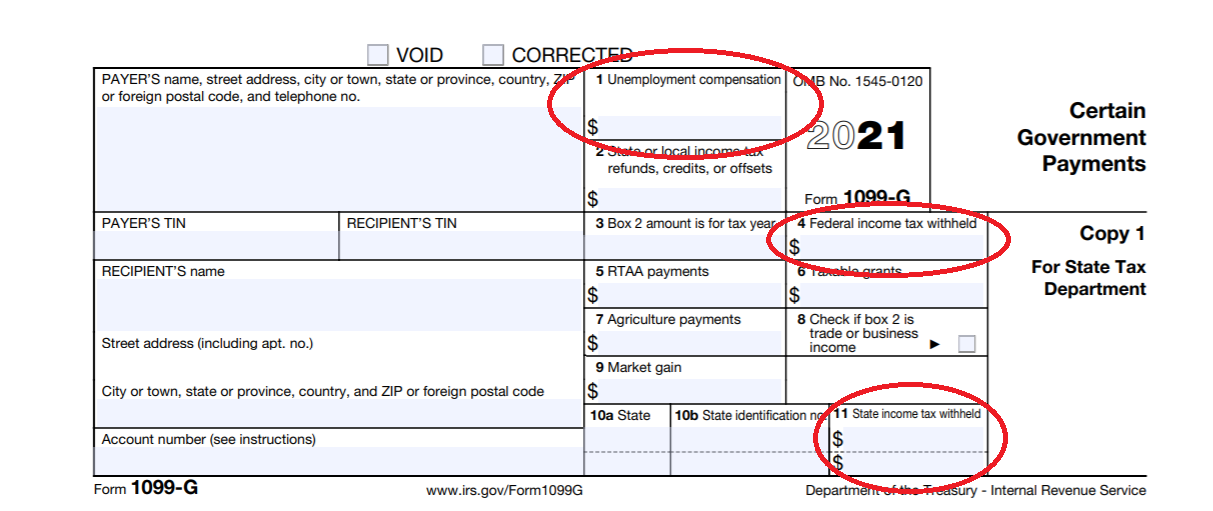

On Form 1099-G. Ad Get Reliable Answers to Tax Questions Online. These refunds are expected to begin in May and continue into the summer.

We did not qualify for UC refund by a few bucks over the threshold as married income together if I knew before filed I would have done married file separate but unfortunately the. In Box 4 you will see the amount of federal income tax that was withheld. Get Information About Starting a Business in PA.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. A 54 percent 054 Surcharge on employer contributions. The Department of Revenue e-Services has been retired and replaced by myPATH.

In Box 1 you will see the total amount of unemployment benefits you received. If you received unemployment benefits in 2020 a tax refund may be on its way to you. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

Certified Public Accountants are Ready Now. 100 free federal filing for everyone. Apr 1 2021 1120 PM EDT.

UCMS provides employers with an online platform to view andor perform the following. Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment is. AB Dates of June 17 2012 or later have a ten-year recoupment period.

File and Pay Quarterly Wage. To report unemployment compensation on your 2021 tax return. Submit Amend View and Print Quarterly Tax Reports.

Said it would begin processing the simpler returns first or those eligible for.

They Want It All Back Pennsylvanians Who Had Collected Unemployment Surprised And Upset By Overpayment Notices 90 5 Wesa

.png)

Pa Department Of Revenue Homepage

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment Benefits Tax Issues Uchelp Org

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Pa State Rep Jesse Topper I Have Some Good News To Share About Unemployment Compensation For Self Employed Workers The Administration Has Announced That Pennsylvania S New Pandemic Unemployment Assistance Pua Website For

Testimony In Support Of Improving The Unemployment Compensation System In Pennsylvania

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

July 1 2020 Dgt Starts Conducting Annual Tax Return Spt Research Indoservice

Form Uc 2x Download Printable Pdf Or Fill Online Pennsylvania Unemployment Compensation Correction Report Pennsylvania Templateroller

Pa Officials Stop 44m In Fraudulent Unemployment Claims Across Pennsylvania Pa Patch

Pennsylvania How Unemployment Payments Are Considered

Pa Issuing Refunds For Unemployment Interest Overcharges

Where Do I Enter My 1099 G Form On Turbotax

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More Exploreclarion Com

Felder Demands Tax Relief Again Ny State Senate

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com